How to Buy Bitcoin in Canada

Bitcoin is the protocol and bitcoin is THE cryptocurrency. At the time of writing, it represents about half of the whole cryptocurrency market, that is itself composed of a thousand+ cryptocurrencies and tokens. On this page, I list different options to buy bitcoins in Canada. These are options that I've tried and can recommend. Other options exist that I have either tried and cannot recommend or that I haven't tested yet. I will add untested options at the end of this article. Whatever options you use, make sure to move your bitcoins to your own (hardware) wallet after purchase; not your private keys, not your bitcoins.

Table of Contents

Bitcoin and Crypto Exchanges in Canada

ShakePay

ShakePay is both an exchange and a digital wallet based in Montreal. It is available as a web or mobile app – and only in Canada. ShakePay is licensed as a money service business (MSB) by FINTRAC and AMF, so is subject to regulatory oversight. It offers fast transactions, secure cold storage, easy conversion between bitcoins and Canadian dollars, and a simple fee structure. Support is available seven days a week.

Pros: Canadian-based; transparent; low trading fees; many funding options; many withdrawing options; responsive customer support

Cons: KYC requirements and process are not clear; slower resolutions of some issues via customer support

BullBitcoin

BullBitcoin is a non-custodial Bitcoin exchange based in Montreal and Calgary. The team behind BullBitcoin are self-proclaimed Bitcoin maximalists. BullBitcoin's services are available only via their website - at the time of writing they do not have a mobile app. They also only serve Canadians. Just like ShakePay, BullBitcoin is licensed as a money service business (MSB) by FINTRAC and the AMF. BullBitcoin offers different options to buy bitcoins with Canadian dollars, and has a simple fee structure that's essentially based on the spread they get between the Bitcoin buy-price they offer vs the BTC-CAD rate. Per our own experience, their customer support are very fast to respond.

Pros: Canadian-based; non-custodial (BTC is sent to your bitcoin wallet); transparent; low trading fees; many funding options; responsive customer support

Cons: KYC process through third-party can be clunky

Newton.co

Newton.co is a cryptocurrency exchange headquartered in Toronto, focused on serving Canadian residents. Accessible through web and mobile app platforms, Newton enables users to trade a range of cryptocurrencies, including Bitcoin. As a money service business (MSB) licensed by FINTRAC, the exchange operates under regulatory oversight. Newton provides competitive spreads and transparent fee structures, though trading costs may vary. Users can expect customer support to be available seven days a week, though responsiveness may fluctuate.

Pros: Based in Canada; multiple funding options; subject to regulatory oversight

Cons: KYC requirements can be time-consuming; responsiveness of customer support may vary

Kraken

Kraken was one of the first cryptocurrency exchanges on the market. It dates to 2011 when exchanges were still in the early adoption stage. Over the years it has been instrumental in defining how exchanges should operate.

You might be interested in Kraken if you are looking for an exchange with a long track record. Note that this platform allows you to buy Bitcoin and other cryptos in numerous fiat/crypto pairs. However, you may not appreciate its software that has been known to prone to operational problems. That said, they recently went through a complete redesign.

Pros: Trusted brand; privacy conscious

Cons: US-based; limited fiat funding options for Canadians

Coinbase

Coinbase is arguably the world's most recognized Bitcoin broker. It is similar to ShakePay in that it acts as a combination of exchange and digital wallet. With recent changes in its business model, Coinbase now offers services to large institutions looking for cryptocurrency custody.

Coinbase comes recommended for its high liquidity and buying limits, ease-of-use, and speed – although it’s not entirely true for Canadians. Coinbase can be accessed through any browser or through their dedicated Android and iOS apps.

Pros: Security; trusted brand; strong financial backing

Cons: Big fees; only accepts credit cards for Canadians; Canadians cannot go back to fiat via Coinbase; US-based

Coinsquare

Next up is Coinsquare, a cryptocurrency exchange located in Toronto. Coinsquare differs from ShakePay and Coinbase in that it started out operating exclusively as a retail exchange. In the years since its founding, Coinsquare has gone on to expand its offerings to include capital market services, and investment advice.

Pros: Low trading fees; good security; strong financial backing

Cons: Excessive credit card fees

Graaf

Unfortunately, Graaf closed its services on May 1st, 2021.

Graaf.one is a Canadian non-custodial Bitcoin exchanged based in Edmonton, Alberta. Just like BullBitcoin, Graaf is strictly Bitcoin-focused and is a FINTRAC-licensed money service business. As the self-titled first Lightning Exchange, Graaf uses the Lightning network to let its users to buy and sell bitcoins with very low fees. As they explain on their site, the Lightning Network allows to use Bitcoin without requiring a network fee for every transaction or needing to wait for confirmations. Once registered, you do need to go through a fairly thorough KYC. After which, you will be able to deposit Canadian dollars in your Graaf account via e-transfer, bank wire or bank draft, and then purchase bitcoins that will be sent directly to your Bitcoin address.

Pros: Canadian-based; non-custodial (BTC is sent to your bitcoin wallet); transparent; very low fees; different funding options; responsive customer support; fast KYC

Cons: A Lightning Wallet is more complex for newbies (but you don’t really need one)

ATMs

Finally, you can purchase bitcoins through any cryptocurrency ATM. This works just like getting fiat cash from a bank ATM. You insert cash to buy your bitcoins, scan the QR code with your mobile hot wallet and that's pretty much it. If you don't have a wallet yet, most ATMs will create one for you. Just be sure to record the information. You will need to write it down or use your smartphone to scan a QR code.

Pros: Requires cash*; no KYC

Cons: High fees; requires cash*; in person transaction (security risk)

*Can be a pro or a con depending on your situation.

Other Options to Buy Bitcoin in Canada

Here are other Canadian cryptocurrency exchanges that we have either just started testing or have not yet tested:

Bitbuy.ca

Not yet tested. Bitbuy is a Canadian platform based in Toronto that allows its users to buy a number of cryptocurrencies.

Coinberry

Not yet tested. Coinberry is a digital asset trading platform that allows its users to buy Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash and Stellar in Canada. Coinberry is based in Toronto.

Coinsmart

Not yet tested. Coinsmart is a digital currency exchange and allows Canadians to buy and sell Bitcoin, Ethereum and other cryptocurrencies. Coinsmart is based in Toronto.

Buy Bitcoin with Interac e-Transfer in Canada

The easiest way to buy bitcoins in Canada is arguably with Interac e-Transfer. All the Canadian big banks and most credit unions work with Interac. All the Canadian exchanges on this page accepts Interac and charges no fees for using that payment method. Interac e-Transfers are not available on Coinbase, but they are on Kraken, another American exchange.

While banks used to charge a $1 fee for Interac transfers, many have started to waive that fees in recent years. Here are the places online where you can buy bitcoins with Interac e-Transfers:

| Buy Bitcoin with Interac e-Transfer in Canada | ||||

| Exchange | Min | Max | Funding Fees | Fee / $100 |

| BullBitcoin | $50 | $25,000 | 0% | $0 |

| Coinsquare | $20 | $10,000 | 0% | $0 |

| Kraken | $5 | $10,000 | 1.5% | $1.5 |

| Newton | $10 | $10,000 | 0% | $0 |

| Shakepay | $5 | $10,000 | 0% | $0 |

Buy Bitcoin via a Wire Transfer or EFT in Canada

The second easiest way to buy bitcoins in Canada is through a Wire Transfer or EFT (Electronic Fund Transfer) or simply Bank Transfer. This is more complicated than an Interac e-Transfer as many banks will require you to do the transaction in person at the bank. It's also not as fast; while an Interac e-Transfer usually takes 30 minutes to reach an exchange, a wire transfer may take a few business days.

One more thing to note, in addition to the funding fees that the exchange may charge you, your bank might also charge you a wire transfer fee depending on the package of your banking account:

| Buy Bitcoin with a Wire Transfer in Canada | ||||

| Exchange | Min | Max | Funding Fees | Fee / $100 |

| BullBitcoin | $50 | $50,000,000 | 0% | $0 |

| Coinsquare | $10,000 | Unlimited | 0% | $0 |

| Kraken | $125 | $300,000 | 0% | $0 |

| Newton | $10,000 | $1,000,000 | 0% | $0 |

| Shakepay | $10,000 | Unlimited | 0% | $0 |

Buy Bitcoin with a Credit Card in Canada

Buying bitcoins with a credit card is the best way to get recked by fees. This should be a solution of last resort. Use Interac e-Transfers if you need bitcoins fast or use a Wire Transfer if for whatever reason you can't use Interac.

In any case, most Canadian exchanges do not accept credit cards for bitcoins. Why? Risk. An ill-intent user could buy bitcoin with his credit card, receive his bitcoins, and then file a chargeback claim with his credit card issuer saying that he never authorized the purchase. Hence, why most exchanges don't accept credit cards.

If you really want to use a credit card to buy your bitcoins, Coinbase seems to be your only choice:

| Buy Bitcoin with a Credit Card in Canada | ||||

| Exchange | Min | Max | Funding Fees | Fee / $100 |

| Coinbase | $1.99 | $25,000* | 3.99% to 50% | $3.84 |

| *Maximum Daily Limit and it varies depending on the level of your account | ||||

Buy Bitcoin with Cash in Canada

And then there's the good 'ole dollar bill. While some say cash is king, when it comes to buying bitcoins, cash can be costly and risky. When it comes to buying bitcoins with cash in Canada, you can either use a Bitcoin ATM or buy physically p2p (peer to peer) by physically meeting a seller in person.

We don't recommend buying bitcoin with cash for two reasons:

- It's costly; you'll have to pay the bigger fees that the typical Bitcoin ATM charges. Moreover, whether it's through an ATM or with someone you transact directly in person, you'll probably have to take a less favorable exchange rate.

- It's risky; most Bitcoin ATMs are in convenient stores and other public spaces; hence anyone can see you using them and deduce you just bought bitcoins. In person is probably more dangerous, as you don't know who you're interacting with and what that stranger's intentions are. There's also a question of legality, as a random individual can't be in the business of selling bitcoins.

We can't provide you with an estimate of the bitcoin transaction fees as this will vary depending on the ATM or person you deal with.

Buying Bitcoin Transaction Fees

In the tables above, we provided how much in funding fees you’ll have to pay each bitcoin exchange or service to fund it with $100 CAD with different payment methods. Please note that the above tables and the following one do not take into consideration whatever banking or credit card fees your bank or financial institution may charge you.

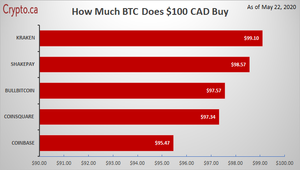

Below we calculated how much bitcoins in Canadian dollars you get for $100 CAD on the various crypto services. This is based on the funding fees and bitcoin trading fees charged by the various exchanges in addition to the spread when they sell bitcoin at (which is how many of these bitcoin exchanges make money). Here's how much $100 CAD will get you on BullBitcoin, Coinbase, Coinsquare, Kraken and Shakepay as of the last time we checked (May 22, 2020):

So what does that mean? Here's a summary:

- Kraken transaction fees and funding fees = if you buy $100 CAD worth of bitcoins, you'll pay $0.90 CAD in total fees;

- Shakepay transaction fees and funding fees = if you buy $100 CAD worth of bitcoins, you'll pay $1.43 CAD in total fees;

- BullBitcoin transaction fees and funding fees = if you buy $100 CAD worth of bitcoins, you'll pay $2.43 CAD in total fees;

- Coinsquare transaction fees and funding fees = if you buy $100 CAD worth of bitcoins, you'll pay $2.56 CAD in total fees;

- Coinbase transaction fees and funding fees = if you buy $100 CAD worth of bitcoins, you'll pay $4.53 CAD in total fees.

Some important points to note: (1) this is based on one punctual verification, so it may fluctuate; (2) this is based on a $100 purchase, the fees may be proportionally lower if you buy more (next time, we'll actually test different purchase amounts for the various exchanges); (3) the fees between the three Canadian exchanges are roughly similar, and, depending on the time of day, one exchange might have lower fees than the other and vice-versa; (4) Kraken does appear to have the lowest total fees, but funding your account from Canada is a pain; and (5) don't use Coinbase.